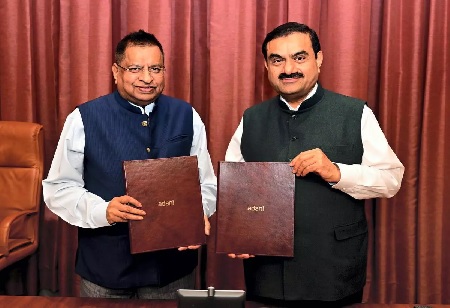

Ambuja Cements Acquires Sanghi Industries

Ambuja Cements, a part of the Adani Group, has successfully concluded the acquisition of Sanghi Industries for an enterprise value of Rs 5,185 crore. This acquisition significantly bolsters the conglomerate's overall cement production capacity, elevating it to nearly 75 million tonnes per annum (MTPA). Ambuja Cements procured approximately 133 million shares of Sanghi Industries valued at Rs 1,627 crore through a block deal on the NSE, purchasing shares at Rs 121.9 per share. Sellers of these shares included Sanghi Industries' promoters such as Alok Sanghi, Aditya Sanghi, Sanghi Polymers, and Samruddhi Investors Services. Additionally, Ambuja Cements acquired roughly 7.3 million shares of Sanghi Industries via an off-market trade, securing a total stake of nearly 141 million shares, equating to a 54.51% ownership in the acquired company.

Ambuja Cements, a part of the Adani Group, has successfully concluded the acquisition of Sanghi Industries for an enterprise value of Rs 5,185 crore. This acquisition significantly bolsters the conglomerate's overall cement production capacity, elevating it to nearly 75 million tonnes per annum (MTPA). Ambuja Cements procured approximately 133 million shares of Sanghi Industries valued at Rs 1,627 crore through a block deal on the NSE, purchasing shares at Rs 121.9 per share. Sellers of these shares included Sanghi Industries' promoters such as Alok Sanghi, Aditya Sanghi, Sanghi Polymers, and Samruddhi Investors Services. Additionally, Ambuja Cements acquired roughly 7.3 million shares of Sanghi Industries via an off-market trade, securing a total stake of nearly 141 million shares, equating to a 54.51% ownership in the acquired company.

According to a statement from Adani Cements, a subsidiary of the Adani Group, the acquisition was funded using internal resources. With this transaction, the Adani Group now encompasses three listed cement companies, including ACC Ltd. Adani Cements stands as India's second-largest cement producer, following UltraTech Cement, which has nearly doubled its cement manufacturing capacity to about 138 MTPA. The deal provides the Adani Group with a clinker capacity of 6.6 MTPA, cement capacity of 6.1 MTPA, and reserves of 1 billion tonnes of limestone. Sanghi Cements' Sanghipuram unit spans 2,700 hectares and represents India's largest single-location cement and clinker production facility. It comprises two kilns, a dedicated 13 MW captive power plant, and a 13 MW waste heat recovery system. The facility is connected to a captive jetty, facilitating smooth logistics.

The statement mentions that the acquisition of Sanghi Industries Limited (SIL) enables Adani Cements to accelerate its distinctive coastal strategy, aiming to boost cement capacity to 15 MTPA along the West Coast, leveraging Sanghi Industries' cost-effective clinker. Adani Cements aims to capitalize on operational synergies from this acquisition to improve efficiency, reduce expenses, and maintain an environmentally sustainable approach to cement production. Following this development, Ambuja Cements' shares surged by 7.22% to close at Rs 508.7 on the BSE, while Sanghi Industries experienced a nearly 5% increase, closing at Rs 129.9. ACC's shares also rose by 8.2%, closing at Rs 2,185, outperforming the benchmark Sensex's 0.63% rise.