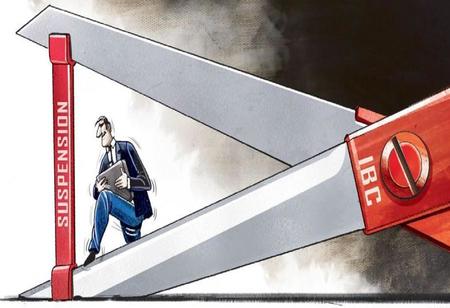

IBC to Stay Suspended Until the End of FY21

Union Finance Minister Nirmala Sitharaman has stated that the Insolvency and Bankruptcy Code (IBC) would continue to be suspended till the end of the current financial year as a measure ot relax the Covid-19 pandemic.

Addressing the Bangalore Chamber of Industry and Commerce via videoconferencing, Nirmala Sitharaman said, “The suspension of the IBC has been postponed even further, from 25th of December to, I think, March 31, 2021.”

As a measure to help the companies facing stress due to Covid-19, the government had brought an Ordinance exempting them from facing corporate insolvency resolution proceedings against any default arising on or after March 25, 2020, for six months. This suspension was extended in September for another three months.

Nirmala Sitharaman stated that the IBC would remain suspended for the entire financial year. “Rightfully so, because every industry has gone through major stress because of the pandemic. And nobody could be drawn towards the insolvency process which may have occurred during the pandemic.”

She further adds, that not only the compliances but even the payments for the taxation which companies have to do were postponed so that nobody is put to difficulty.

The government had earlier announced it was difficult to find sufficient resolution applicants to rescue the corporate persons who might default in discharge of their debt obligation and that the Covid-19 pandemic had impacted the economy all over the world, creating uncertainty and stress for businesses for reasons beyond their control.

The IBC law empowers the government to issue a notification to extend the suspension for a period not exceeding one year. This suspension of the IBC does not apply to any default committed before March 25, 2020. The three sections that stand suspended include 7, 9, 10. A new Section, 10A, was earlier added to suspend the IBC.

Notable portion of insolvency cases are facing liquidation since the outbreak of Covid-19, and experts feel there is a lack of investor interest in stressed assets at present and further extension of the suspension may give a breather to many companies.