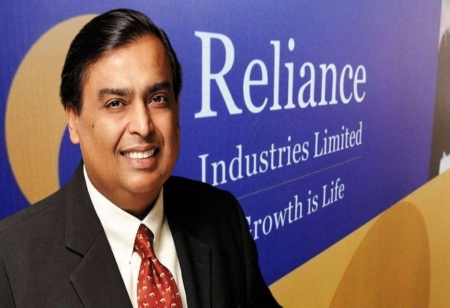

Reliance Industries Receives Approval To Demerge Its Finance Subsidiary

Reliance Industries (RIL), led by Mukesh Ambani, announced on Thursday that it had received shareholder and promoter approval to demerge its financial services arm Reliance Strategic Investments Ltd (RSIL).

Reliance Industries (RIL), led by Mukesh Ambani, announced on Thursday that it had received shareholder and promoter approval to demerge its financial services arm Reliance Strategic Investments Ltd (RSIL).

In a filing with the stock exchanges, RIL stated that 99.9% of shareholders voted in favour of the demerger at a shareholders' meeting on May 2, i.e., Tuesday.

According to a stock exchange filing, RIL has issued one share of the demerged company worth Rs 10 for every share they own in Reliance Industries.

RSIL will be renamed Jio Financial Services Ltd (JFSL) following the demerger.

Last October, the Ambani-owned group approved the demerger of the financial services arm.

RSIL is currently an RBI-registered non-deposit-taking systemically important non-banking financial company and a wholly-owned subsidiary of RIL. Former ICICI Bank MD and CEO KV Kamath will serve as non-executive chairman of Jio Financial Services, whose shares will be listed on both the BSE and the National Stock Exchange.

"JFS will be a truly transformational, customer-centric, and digital-first financial services enterprise offering simple, affordable, innovative, and intuitive financial services products to all Indians," RIL CMD Mukesh Ambani said last October when the demerger was announced.

"JFS is uniquely positioned to capture multiple growth opportunities in financial services," he continued, "bringing millions of Indians into formal financial institutions."